9 Best Stock Analysis Tools to Elevate Your Investment Strategy in 2025

In today’s competitive landscape, stock analysis is essential for informed investment decisions. Platforms offering stock market data are invaluable resources for investors, analysts, and financial institutions. Analytical tools streamline the process, enabling users to extract and interpret data effectively. Here are the 9 top stock analysis tools in 2025 that will empower you to uncover trends, optimize your portfolio, and enhance your investment strategy.

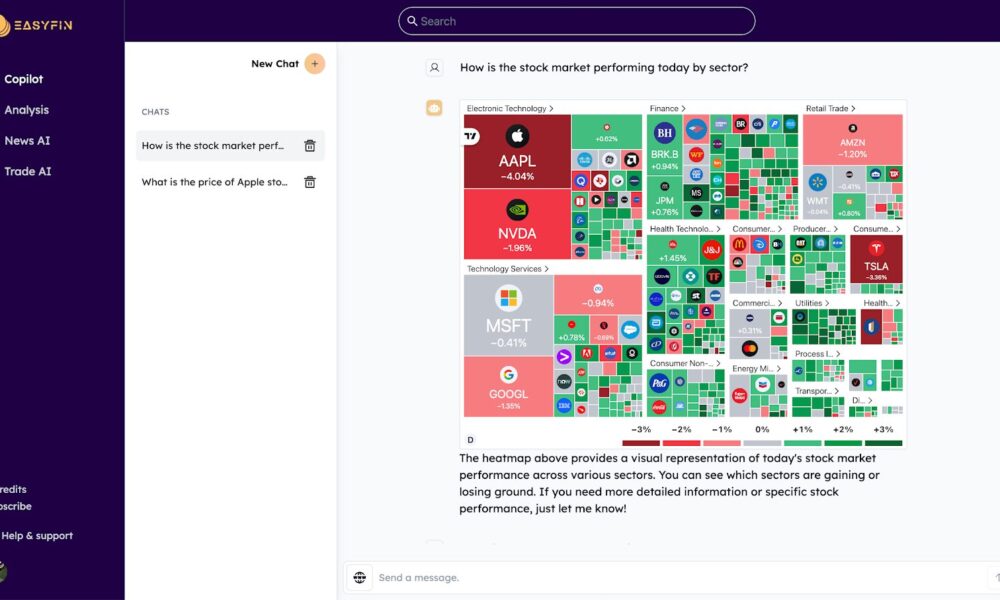

1.EasyFin: Your Ultimate AI-Powered Investment Research Assistant

EasyFin is an innovative platform designed to revolutionize stock analysis, investment research, and data-driven decision-making for teams of all sizes. By harnessing the power of AI, EasyFin automates time-consuming tasks, allowing investment professionals to focus on strategic insights and market opportunities.

EasyFin enhances the research process with a comprehensive suite of tools that streamline stock analysis, generate real-time stock news, and facilitate seamless team collaboration. As a leading AI-powered assistant, it automates financial data analysis, uncovers key insights, and produces accurate reports at the click of a button. This empowers teams to make informed decisions quickly and efficiently in today’s fast-paced markets.

Benefits:

- AI-Powered Automation: Automates key tasks throughout the investment research lifecycle, including analyzing financial data and tracking stock news, reducing manual work and enhancing productivity.

- Instant Reports: Generates comprehensive reports on financials, KPIs, market trends, and stock analysis in real-time, providing actionable insights.

- Comprehensive Data Analysis: Access detailed financial data and the latest stock news on over 100,000 global public companies, ensuring informed decision-making.

- Seamless Team Collaboration: Facilitates easy sharing of reports and insights, improving team workflows and alignment.

With EasyFin, investment teams can streamline their workflows, automate repetitive tasks, and gain powerful insights into stock analysis and stock news, all within a secure and scalable platform. Start your journey towards smarter investment research today!

2: StockAnalyzer

StockAnalyzer is an essential tool for investors seeking to make informed decisions in the dynamic stock market. This comprehensive platform provides real-time data, analysis, and insights on over 100,000 stocks and funds, including all companies listed in the S&P 500 index.

StockAnalyzer enhances the investment experience by offering an intuitive interface that allows users to access accurate information quickly. As a leading stock analysis platform, it features an advanced stock screener, market news updates, and a heatmap to visualize market movements effectively. Additionally, users can track top gainers and losers, monitor premarket and after-hours trading, and stay updated with corporate actions and earnings calendars.

Benefits:

- Access to real-time stock prices, news, and financials;

- Advanced stock screener to filter stocks based on various criteria;

- Comprehensive market news and trending articles for informed decision-making;

- User-friendly watchlist feature to monitor favorite stocks and ETFs;

- Detailed IPO information, including recent and upcoming IPOs.

With StockAnalyzer, investors can streamline their research process and gain a competitive edge in the ever-evolving financial landscape.

3: Stock-Analyzer

Free online stock information platforms are essential for both individual investors and large trading firms. To transform the stock analysis process, StockAnalyzer was introduced as a comprehensive Stock Information Hub. This platform is designed to assist investors in analyzing, tracking, and making informed decisions about stocks and funds with ease.

StockAnalyzer enhances the investment experience by providing an intuitive and efficient environment for stock research. As a leading Stock Information Hub, it offers accurate data on over 100,000 stocks and funds, including real-time stock prices, financials, forecasts, and charts. Moreover, it features advanced tools like a Stock Screener, Market Movers, and an IPO Calendar, allowing investors to explore various investment opportunities effortlessly. A user-friendly Watchlist feature enables users to track their favorite stocks and receive timely updates, ensuring they stay informed about market movements.

Benefits:

- Access to accurate information on a vast array of stocks and funds.

- Advanced tools for screening and comparing stocks.

- Real-time updates on market movers, including top gainers and losers.

- Comprehensive IPO information, including recent and upcoming IPOs.

4: Simply Wall St

Simply Wall St is an innovative platform designed for long-term stock investors, providing powerful tools and insights to enhance portfolio management and investment research. This all-in-one solution is tailored to help both novice and experienced investors make informed decisions and build lasting wealth.

Simply Wall St streamlines the investment process by offering a comprehensive suite of features, including a Portfolio Tracker, Dividend Tracker, Stock Screener, and Community Narratives. The platform empowers users to analyze businesses quickly through visually appealing reports that present unbiased insights, enabling investors to identify hidden gems and assess potential risks and rewards effectively.

Benefits:

- Portfolio Tracker & Analysis: Gain a top-level view of diversification, risks, and overall performance while tracking capital gains and dividends.

- Intelligent Updates: Stay informed with weekly insights and alerts on significant market changes that impact stock valuations.

- Stock Screener: Easily filter stocks based on various characteristics and metrics to find quality investments tailored to your strategy.

- Investing Ideas: Access curated collections and themes that inspire investment opportunities across diverse sectors, such as Artificial Intelligence and Nuclear Energy.

- Community Narratives: Engage with a community of over 7 million investors, sharing insights and strategies to enhance your investment journey.

With its user-friendly interface and rich repository of financial data, Simply Wall St is an essential tool for investors looking to navigate the complexities of the stock market and achieve their financial goals.

5: Indian Stock Screener

Investors in India can greatly benefit from the innovative stock screening and fundamental analysis tool provided by Mittal Analytics Private Ltd. This platform is specifically designed to help users analyze and screen Indian stocks effectively, making it an essential resource for both novice and experienced investors.

The Indian Stock Screener allows users to create custom stock screens, ensuring they can target specific investment criteria. With access to 10 years of financial data, investors can run detailed queries to identify trends and opportunities in the market. The tool also offers premium features, including commodity prices for over 10,000 commodities, enabling users to stay updated on market trends.

Additionally, the platform provides insights into shareholder structures, allowing users to search for companies where individuals hold over 1% of the shares. Keeping users informed, the stock screener also includes a section for the latest announcements, where investors can browse, filter, and set alerts for important updates.

Benefits:

- Comprehensive stock screening and analysis for Indian stocks;

- Access to 10 years of financial data for informed decision-making;

- Premium features including commodity prices and shareholder insights;

- Real-time alerts for the latest company announcements.

With the Indian Stock Screener, investors can enhance their market analysis and investment strategies with ease.

6: Ticker

Ticker is an essential tool for investors seeking to enhance their stock market analysis and investment strategies. This comprehensive platform offers a free suite of features designed to aid in the fundamental analysis of stocks, making it easier for users to identify promising investment opportunities.

Ticker empowers users by providing detailed insights into financial statements, including balance sheets, profit and loss statements, and cash flow reports. By facilitating in-depth analysis of a company’s financial health, Ticker helps investors make informed decisions based on solid data rather than speculation.

Key Features:

- Comprehensive Financial Analysis: Access detailed financial data and ratios to evaluate a company’s performance.

- Balance Sheet Insights: Understand a company’s assets, liabilities, and equity to assess financial stability and risk.

- Ratio Analysis: Utilize various key financial ratios like P/E, EPS, and P/B ratios to gauge a stock’s value and potential returns.

- Peer Comparison: Compare companies within the same industry to identify the best investment options.

- Curated Investment Bundles: Explore professionally crafted bundles of stocks based on proven investment strategies, tailored to different investing styles.

Ticker’s user-friendly interface and robust analytical tools are designed to help both novice and experienced investors navigate the stock market effectively. By leveraging Ticker, investors can gain a clearer understanding of market trends, uncover undervalued stocks, and track potential multibagger opportunities.

Benefits:

- Easy access to comprehensive financial data and analysis tools.

- Enhanced ability to compare and identify high-performing peers.

- Daily updates and insights to stay informed about market movements.

- Supports informed decision-making with a focus on calculated risks.

With Ticker, stock market analysis becomes a streamlined process, allowing investors to focus on building a successful investment portfolio.

7: MarketScreener Insights

MarketScreener serves as a valuable platform for investors and financial professionals seeking in-depth stock market analysis and expert insights. This comprehensive tool is designed to empower users with the information necessary to navigate the complexities of the financial markets effectively.

MarketScreener enhances the investment experience by offering a wide array of resources, including real-time stock quotes, detailed analysis reports, and curated news articles. As a leading financial portal, it provides users with powerful tools for stock screening, portfolio management, and market trend analysis. Additionally, the platform features a collaborative environment where investors can share insights and strategies, fostering a community of informed decision-making.

Benefits:

- Access to real-time market data and analysis;

- Comprehensive coverage of global equities and indices;

- Customizable stock screening tools to identify investment opportunities;

- In-depth articles and expert opinions on market trends and investment strategies.

With its user-friendly interface and extensive resources, MarketScreener is an indispensable ally for anyone looking to enhance their investment knowledge and make informed financial decisions.

Stock analysis is a crucial process that investors and traders use to evaluate and investigate various trading instruments, investment sectors, or the stock market as a whole. Often referred to as equity analysis or market analysis, it assists in making informed buying or selling decisions based on comprehensive market insights.

Stock analysis provides a framework for investors to understand the economy, stock market trends, and individual securities. By studying historical and current market data, traders can develop methodologies to select appropriate stocks for trading. This process also involves identifying optimal entry and exit points for investments.

Benefits:

- Enhanced Decision-Making: Provides insights that help in making informed investment choices.

- Understanding Market Trends: Offers a clearer view of the stock market dynamics and economic indicators.

- Risk Management: Aids in identifying potential risks and rewards associated with investments.

- Strategic Planning: Helps in developing strategies for both short-term and long-term investments.

Types of Stock Analysis

Stock analysis can be categorized into two primary types:

- Fundamental AnalysisFundamental analysis evaluates a company’s intrinsic value by examining its financial health and economic environment. Investors utilize various metrics to assess whether a company’s stock price reflects its true value. Key indicators in fundamental analysis include:

- Earnings per Share (EPS): Indicates a company’s profitability; an increasing EPS is generally viewed positively.

- Price to Earnings Ratio (P/E): Reflects how much investors are willing to pay for a company’s earnings, with higher values suggesting potential overvaluation.

- Price to Earnings to Growth Ratio (PEG): Considers earnings growth along with the P/E ratio for a more comprehensive view of stock valuation.

- Price to Book Ratio (P/B): Compares market value to book value, indicating how much investors are willing to pay for a company’s equity.

- Return on Equity (ROE): Measures how effectively a company generates profit from its assets; higher values suggest better performance.

- Dividend Payout Ratio: Reflects the percentage of earnings paid to shareholders, indicating a company’s profit distribution policy.

- Technical AnalysisTechnical analysis focuses on market activity data, such as price movements and trading volume. Analysts use charts and technical indicators to identify patterns that may signal future price movements. Key assumptions of technical analysis include:

- The Market Knows It All: All available information is reflected in a security’s price.

- Price Follows a Trend: Once established, trends are likely to continue in the same direction.

- History is Likely to Repeat: Price movements often follow historical patterns due to market psychology.

9: TipRanks

TipRanks is a comprehensive research platform that empowers investors to make smarter, data-driven investment decisions. Designed for both individual investors and financial professionals, TipRanks levels the playing field by making institutional-grade research tools and data accessible to everyone.

The platform provides an array of features that facilitate informed investing, including stock analysis, expert ratings, and market insights. With tools like the Smart Score, which evaluates stocks based on various metrics, users can identify opportunities and gauge the potential performance of their investments. Additionally, TipRanks offers a user-friendly interface that allows investors to track their portfolios, compare stocks and ETFs, and stay updated with the latest market news and trends.

Benefits:

- Comprehensive research tools for informed investing;

- Smart Score system for evaluating stock potential;

- Daily updates on analyst ratings and insider trading;

- Collaboration with top financial experts and institutions for reliable insights.

TipRanks is an essential resource for anyone looking to enhance their investment strategy and stay ahead in the dynamic stock market.

Conclusion

Stock analysis tools are transforming the investment landscape by tackling numerous market challenges and offering cutting-edge solutions. These platforms are reshaping how investors evaluate assets, where many facets of analyzing, forecasting, and managing portfolios are becoming more automated and data-driven. This evolution enables investors, analysts, and traders to concentrate on strategic decision-making and develop exceptional investment strategies.

Each of the tools highlighted above presents distinct advantages and functionalities. Identifying your specific investment objectives and analytical requirements will assist you in selecting the appropriate stock analysis tool to elevate your investment process and realize your financial aspirations.